Islamic Home Buying Scheme with a Minimum 5% Deposit.

Buy the home you love, in an area you actually want to live, without a mortgage and debt-free.

Our Islamic Home Buying Scheme ensures that you can stay true to what you believe in, and still buy a home without a mortgage.

When you buy a home with us, you won't pay any interest according to our Islamic Home Buying Process that don't provide any debt. Simple.

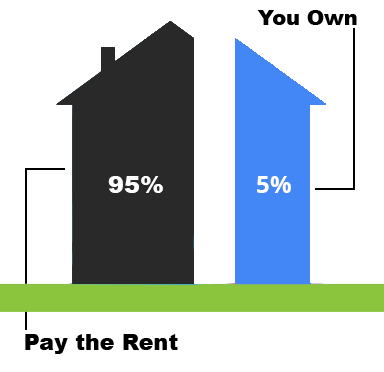

Our funding partners pay for the rest.

You pay rent for the rest.

Pay less rent by increasing your ownership, but only if you want to.

We help you buy a better and bigger home debt-free. It is not easy to finance your own home alone, so we are here for you.

You will need a minimum investment equal to 5% of the Property Purchase Cost.

We don’t have a minimum household income per se, however, the rental of your property should not exceed 40% of your annual income.

We’ll need to know:

- How much money you have for a deposit(minimum £10,000)

- Sole or Joint Application

- Your annual and household income

- Your credit report

- If you’ve been declared bankrupt or defaulted payments

We may also ask you for some additional information depending on your personal circumstances.

No. Mortgages are debt based financial products, which is usually reflected on your credit record. With us, you’re not borrowing money. Instead, your home is partially owned by you and the remainder by our funding partners.

Unlike a mortgage, you are not obligated to repay the full cost (plus interest) of the property over a period of time.

You will however be required to pay rent to the investors, on the share that you don’t own.

No, our product allows you to remain debt free.

Unlike the shared ownership schemes, if you choose to sell your home, your property can be sold in the normal way on the open market, without restrictions some of the shared ownership schemes have. For example:

No ‘right to first refusal'. Generally shared ownership providers have first refusal to try to sell your house before you are permitted to market your house on the open market. Their pool of suitable investors is usually limited and as such this often results in a delay to your sale process.

No additional restrictions on your buyer. A number of shared ownership providers will only sell your property to individuals who meet their strict eligibility criteria, which is in addition to the usual criteria placed on buyers from their mortgage lender. To make matters worse, there are a limited number of mortgage lenders willing to loan on shared ownership properties.

Limited Shared Ownership Stock. There are currently only a small number of shared ownership properties available to purchase in the property market. However, with our CrowdToLive® product you are able to apply with most properties currently listed for sale in the open market.

Suitability. We acknowledge that in some cases Shared Ownership might be a better fit than our CrowdToLive® scheme.